Regular and accurate cash flow projections can help build the organization's reputation with collaborators, lenders and investors. Having cash flow projections can help assure people and other entities that financed the organization that it's likely to have the funds to repay them in the future. It acts as an extra assurance for investors, supporters and banks. Projecting the company's cash flow can ensure that it has the available cash for these operations without it affecting everyday activities. Knowing the amount of cash the organization is likely to have available in the future can help it plan certain operations, like hiring new employees, making payouts to interested parties and making large purchases. It can help coordinate business operations.

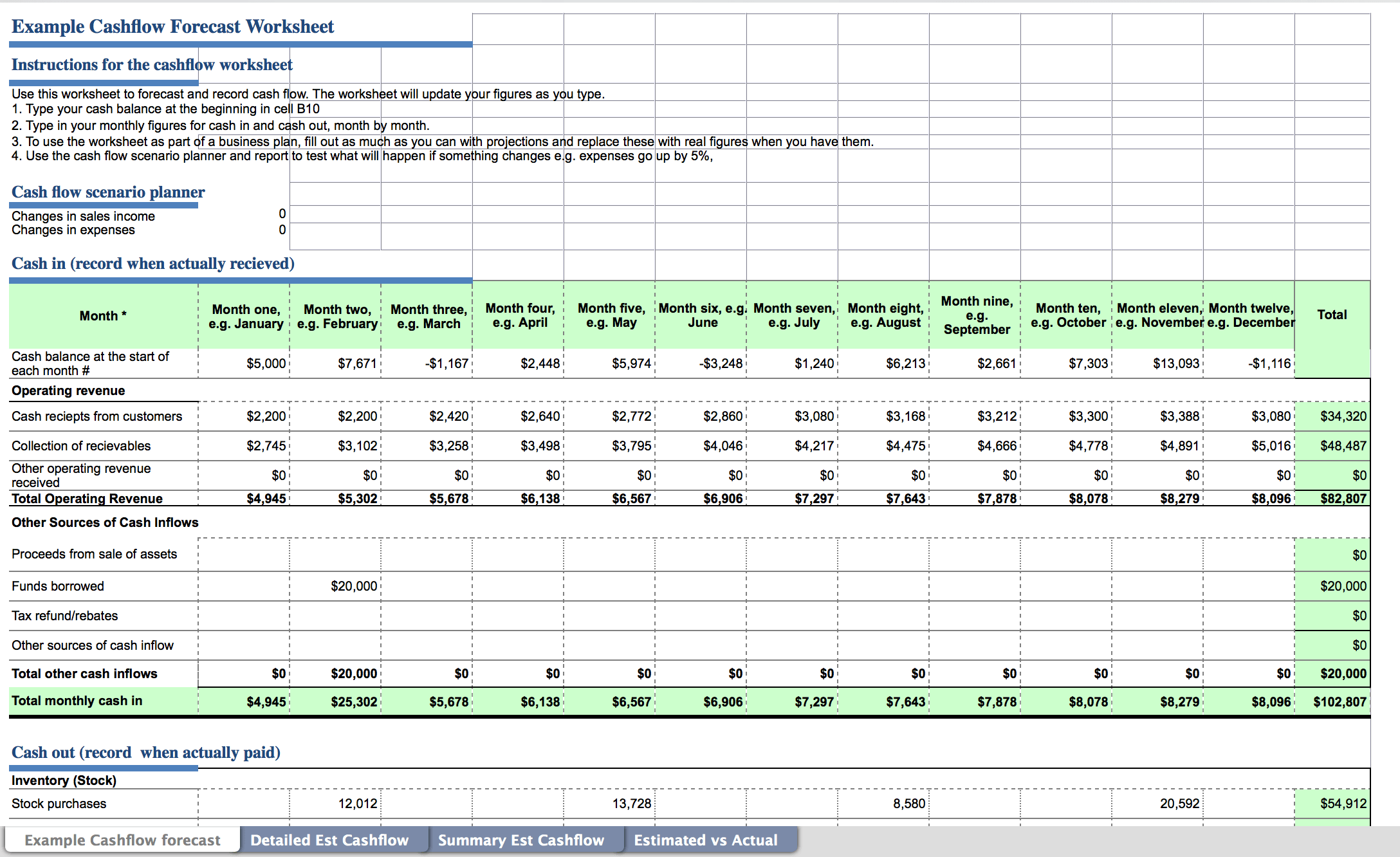

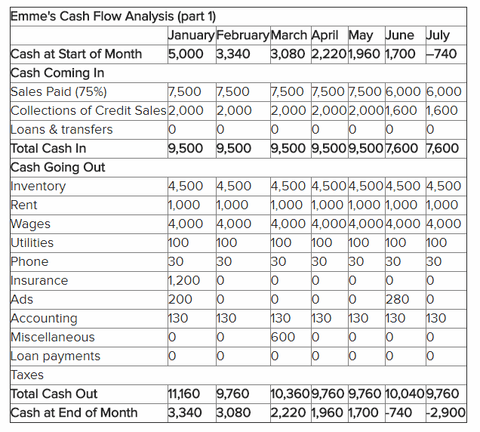

Knowing this ahead of time allows the finance and management team to adjust the organization's operations in ways that ensure it stays operational during times of reduced cash flow. Projecting an organization's cash flow can help you discover the likelihood of it requiring additional cash at a certain point in the future. It can help you identify a potential lack of cash availability. These are some of the advantages of projecting an organization's cash flow : Related: A Definitive Guide to Incremental Cash Flow (With Examples) Advantages of projected cash flow This allows business supporters to make financial decisions that consider likely but unconfirmed sources of income and expenditure. For instance, a business owner may anticipate extra staff requirements during the holiday period and include the expected rise in costs associated with recruiting and training new personnel. Some businesses incorporate expected situations into their cash flow projections to improve their accuracy. You can also do it for shorter periods, like for a week, month or half a year. Organizations usually make cash flow projections for a 12-month time period. It involves calculating all funds going in and out and determining the amount of cash left at the end of the chosen period.

Projected cash flow, also called a cash flow forecast, is an estimate of the amount of money that an organization expects to gain and spend in a certain time period.

PROJECTED CASH FLOW HOW TO

In this article, we discuss what projected cash flow is, list some benefits of calculating it and explain how to perform this process, then give tips and example to help you measure projected cash flow on your own. Learning more about projected cash flow can also be beneficial for your career. If your profession involves managing an organization's finances, knowing what its projected cash flow is and how to calculate it can help you formulate viable financial strategies. An organization's cash flow is a measure of the net amount of funds going in and out.

0 kommentar(er)

0 kommentar(er)